Browsing the Sole Trader Bounce Back Loan: What If I Can't Pay It Back?

Browsing the Sole Trader Bounce Back Loan: What If I Can't Pay It Back?

Blog Article

Uncovering the Conveniences and Application Process of Financial Assistance Through Recover Loan

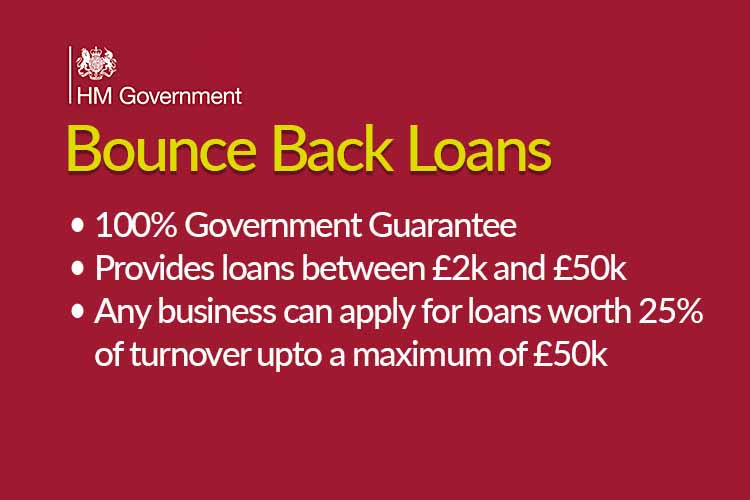

The Bounce Back Finance scheme has actually arised as a critical lifeline for lots of enterprises, using a streamlined application procedure and beneficial terms. Dropping light on the qualification standards, benefits, application procedure, and repayment terms of the Bounce Back Finance can be critical in encouraging companies to make informed decisions about their monetary wellness.

Eligibility Requirements for Get Better Finance

Additionally, to get approved for a Recuperate Financing, business has to not have actually already received a car loan with the Coronavirus Service Disturbance Lending System (CBILS), the Coronavirus Big Service Disturbance Funding System (CLBILS), or the Bank of England's COVID Corporate Funding Center Scheme. It is important to give exact information and documents throughout the application procedure to show qualification and ensure a smooth authorization process (sole trader bounce back loan). By satisfying these criteria, services can access the monetary assistance they require to navigate the challenges presented by the pandemic

Benefits of Recover Finance

Having fulfilled the strict qualification requirements for a Recuperate Loan, services can now explore the various benefits that feature this financial backing option. One key advantage is the simpleness and rate of the application process. Compared to standard loans, Recover Lendings include minimal documents and can often be approved swiftly, providing companies with rapid access to much-needed funds. In addition, these finances included a government-backed assurance, giving loan providers confidence to give support to a broader variety of companies, including those with restricted credit report or collateral.

An additional significant advantage of Recover Loans is the beneficial terms provided. With a set rates of interest of 2.5%, companies can secure financing at a lower expense compared to various other kinds of financing. The preliminary 12-month repayment vacation allows organizations to funnel their resources towards recovery and development before starting to settle the finance. This flexibility can be crucial for organizations making every effort to browse unclear economic conditions and ensure long-lasting sustainability.

Application Process Streamlined

Streamlining the application process for a Bounce Back Car Loan has been a critical focus to enhance accessibility for businesses in need of financial backing. The streamlined application process involves filling in an on-line kind supplied by the taking part loan providers. To use, services need to provide standard details such as their service details, the lending amount called for, and confirmation that they meet the qualification standards. Unlike conventional car loan applications, the Bounce Back Financing application needs marginal paperwork, decreasing the time and initiative needed to finish the process. Additionally, the government-backed plan has gotten rid of the demand for personal assurances and extensive credit rating checks, making it less complicated for services to access the funds swiftly. This structured approach not only speeds up the application process yet likewise makes certain that companies can obtain the monetary support they require quickly, aiding them navigate with challenging times with higher convenience.

Comprehending Finance Settlement Terms

The streamlined application process for the Bounce Back Lending has actually led the way for businesses to currently comprehend the crucial facet of finance payment terms. The Bounce Back Lending supplies positive repayment terms, consisting visit this site right here of a payment vacation for the very first 12 months, no fees, and a reduced fixed passion price of 2.5% per year afterwards. what if i can't pay back my bounce back loan sole trader.

It is vital for debtors to familiarize themselves with the car loan payment routine, including the regular monthly installation amounts and due dates, to make certain timely repayments and preserve a good monetary standing. Failing to comply with the agreed-upon payment terms can result in extra fees, penalties, and damage to the consumer's why not try this out debt rating. Therefore, staying educated and proactive in managing loan repayments is vital for the lasting financial health of business.

Tips for Taking Full Advantage Of Get Better Loan Benefits

To fully take advantage of the benefits of the Bounce Back Lending, calculated click for info economic planning is essential for services intending to optimize their financial support. Services need to prioritize making use of the car loan for tasks that will straight add to revenue generation or cost savings. By tracking costs, organizations can make changes as needed to stay on track with their financial goals and make the most of the support supplied by the Bounce Back Financing.

Conclusion

In conclusion, the Recover Funding supplies financial backing to eligible services with simplified application processes and beneficial payment terms. Comprehending the qualification requirements, benefits, and payment terms is necessary for maximizing the benefits of this lending. By following the outlined tips, businesses can make the many of the financial backing supplied with the Recover Car Loan.

Additionally, to qualify for a Bounce Back Funding, the organization has to not have actually already received a loan via the Coronavirus Organization Disruption Funding Scheme (CBILS), the Coronavirus Large Organization Disruption Car Loan Scheme (CLBILS), or the Financial institution of England's COVID Corporate Financing Facility System. Compared to traditional loans, Jump Back Car loans involve marginal documents and can often be accepted swiftly, giving services with rapid accessibility to much-needed funds. To apply, organizations need to give fundamental information such as their service details, the finance amount called for, and confirmation that they fulfill the eligibility requirements. Unlike traditional finance applications, the Bounce Back Car loan application calls for minimal documents, minimizing the time and initiative needed to finish the procedure.The streamlined application procedure for the Bounce Back Car loan has paved the method for businesses to now understand the essential facet of car loan settlement terms.

Report this page